Canadian seniors who choose to stay at home can access government assistance and benefits, such as home repairs, adaptations, and healthcare and support services.

By aging in place, they can maintain their independence and have a better quality of life than being in institutional care.

This article will cover the various government benefits designed to support seniors at home, including the Seniors Home Adaptation and Repair Program (SHARP), Canadian Dental Care Plan (CDCP), Old Age Security (OAS) and the Guaranteed Income Supplement (GIS).

Government Assistance for Seniors Living at Home

Seniors Home Adaptation and Repair Program (SHARP)

The Seniors Home Adaptation and Repair Program (SHARP) is an initiative offering financing to low- to moderate-income seniors in Alberta to assist them with home repairs, adaptations, and maintenance. The aim is to ensure their homes are safe and suited for aging in place.

SHARP comes in the form of low-interest home equity loans that eligible seniors can apply for with the Government of Alberta to finance suitable projects, such as stair lifts, bathroom or walk-in tubs, doorway widening, and upgrades of furnaces and hot water tanks.

Eligibility

To avail of this benefit, you must meet the following:

- Age 65 or older

- A resident of Alberta for at least 3 months

- A Canadian citizen or permanent resident of Canada

- An annual combined income of $75,000 or less (if you have a spouse)

- Listed as a registered owner of a residential property in a Land Title Office

- A minimum of 25% equity in your home

Loan Details

- Maximum loan amount of $40,000

- Interest rate of 7.20% (adjusted every 6 months in April and October)

- No need to make monthly repayments

- Loan can be repaid at any time. It will automatically become due when you sell your home, if it is no longer your primary residence, or if you are not the registered owner anymore.

How to Apply

To apply for the loan, submit the following documents:

- A completed loan application form

- Signed loan agreement

- A statement of consent from the Canada Revenue Agency

- Current property tax bill or assessment

- Receipts or estimated costs of requested home repairs, renovations and adaptations

- Completed Direct Deposit form

After completing the form, send it online or to the address below. Include the required supporting documents like your property tax assessment or bill and estimates or receipts.

Address: Seniors Home Adaptation and Repair Program (SHARP), PO Box 1050 STN Main, Edmonton, Alberta T5J 2M1.

First Nations and Inuit Home and Community Care (FNIHCC) Program

This program is for all seniors, people of any age with disabilities, and those with chronic or acute illnesses in First Nations and Inuit communities in Canada. It provides services like home support services, nursing care, rehabilitation and therapy, and personal care.

Eligibility

To be eligible for FNIHCC, individuals must meet the following:

- A resident of an Inuit community, First Nation reserve or community

- Have been assessed as needing continuing care services

- Can safely receive care services following established standards, policies and regulations

How to Apply

To apply for FNIHCC, visit or contact your regional office.

Home and Community Care Support Services in Ontario

The Home and Community Care Support Services is a network of organizations that provide various healthcare and support services to eligible individuals in their homes and communities in Ontario.

The aim is to help people live comfortable and independent lives and avoid or delay the need for long-term care services. Previously referred to as Local Health Integration Networks, the group is responsible for:

- Evaluating your care needs

- Determining your eligibility for their services

- Formulating a care plan for you once you pass the eligibility requirements

The professional services they offer include the following:

- Healthy eating

- Nursing care

- Physiotherapy

- Speech-language therapy

- Occupation therapy

- Social work

How to Apply

Contact your local branch to determine if you qualify for Home and Community Care Support Services. If you are eligible, you may receive funding from the government to pay for the services specified in your care plan from your preferred provider.

Minor Home Repairs Grant in New Brunswick

The Minor Home Repairs Grant in New Brunswick helps low-income homeowners in the province to live an independent lifestyle by providing financial support that helps with the cost of essential home repairs.

An eligible senior can receive a one-time, non-repayable amount of up to $1,500, one per household. The grant is provided to help eligible homeowners improve the accessibility and safety of their homes, remain longer in their residences and preserve their independence.

Minor home repairs covered include:

- Handrails, grab bars and ramps

- Improved lighting

- Non-slip floor surfaces

- Flooring repairs

Eligibility

To be eligible, you must meet the following:

- Must be 65 years old or older

- A resident of New Brunswick

- With total household income at or below the low-income seniors’ benefit limits

- Have completed the Seniors Health, Well-being, and Home Safety Review in your home

How to Apply

- Register online and request a Seniors Health, Well-being, and Home Safety review.

- Provide the required personal details, including name, phone number, address and preferred language.

- Wait for a representative to contact you at your chosen schedule.

- After the review is completed, apply for the Senior Minor Home Repairs Grant by calling Social Development at 1-833-733-7835.

- Provide the following requirements:

- Proof of income

- A statement with details on the repair work necessary and how it will be done

- For renters, your landlord’s written approval to conduct the adaptation

- Contractor estimates of the repair work

Other Types of Government Assistance (and Pensions) for Seniors with Low Income

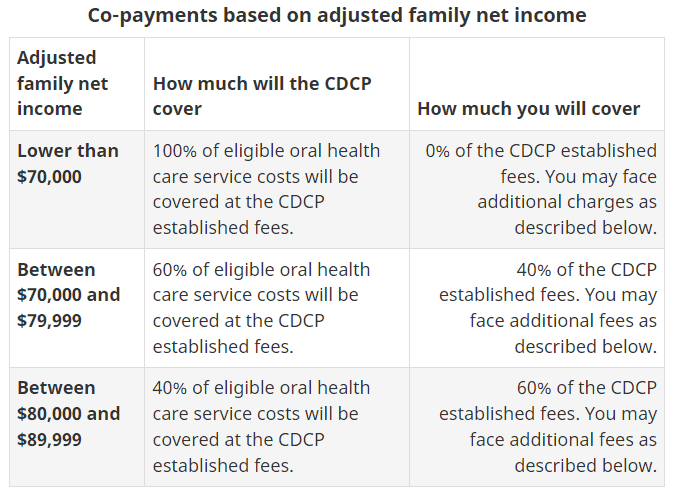

Canadian Dental Care Plan (CDCP)

The CDCP is available to low-income seniors to help with the costs of oral health care. It will include a range of services including diagnostic, preventive, restorative, endodontic, preventive and periodontal, oral surgery, and more.

Eligibility

To qualify for CDCP, you must meet all these requirements:

- Doesn’t have access to dental insurance

- Have an adjusted family net income of less than $90,000

- A Canadian resident for tax purposes

- Have filed the previous year’s tax return

How to Apply

For seniors aged 65 and above, applications have started in December 2023.

Seniors are also now eligible to apply for the CDCP online even without an invitation letter. Make sure to have the following information to complete your application:

- Social Insurance Number

- Date of Birth

- Full name

- Home and mailing address

- List of the dental coverage you have through government social programs (if applicable)

After you have qualified, you’ll receive a welcome package from insurer Sun Life. The package will indicate the date you can start seeing an oral health provider.

How Much Will Be Covered

The CDCP will base reimbursements on the established CDCP fees and your adjusted family net income. Co-payments will also be based on your adjusted family net income, as shown below:

Old Age Security (OAS)

The OAS is a pension program available to eligible seniors. Although the monthly payment provides basic income support to seniors, it doesn’t require prior working history or plan contributions.

Eligibility

- Be 65 years old or older

- A citizen or legal resident of Canada

- Have resided in Canada for at least 10 years after turning 18

How to Apply

Unless you are automatically enrolled in the OAS program, you may need to submit an application to receive the OAS benefits. You can apply online through My Service Canada Account or via paper application.

Maximum Payments and Income Thresholds

Payment Dates for 2024

- January 29, 2024

- February 27, 2024

- March 26, 2024

- April 26, 2024

- May 29, 2024

- June 26, 2024

- July 29, 2024

- August 28, 2024

- September 25, 2024

- October 29, 2024

- November 27, 2024

- December 20, 2024

Guaranteed Income Supplement (GIS)

The Guaranteed Income Supplement is an income-based, non-taxable benefit aimed at providing financial support to low-income Old Age Security pensioners aged 65 or older.

Eligibility

- 65 years old or older

- A resident of Canada

- Currently an Old Age Security (OAS) pensioner

- Meets income requirements

How to Apply

If you are receiving OAS, you may be automatically enrolled for GIS. Otherwise, you will receive a letter asking you to apply for GIS. You can apply online through your My Service Canada Account or through a paper application.

Maximum Payments and Income Thresholds

| Guaranteed Income Supplement (65+ years old) | ||

| Your situation | Your annual net income must be | Maximum monthly payment amount |

| Single, widowed or divorced | less than $21,624 | up to $1,065.47 |

| With a spouse/common-law partner receiving a full OAS pension | less than $28,560(combined) | up to $641.35 |

| With a spouse/common-law partner receiving the Allowance | less than $39,984(combined) | up to $641.35 |

| With a spouse/common-law partner who is not receiving an OAS pension or Allowance | less than $51,840(combined) | up to $1,065.47 |

Payment Dates for 2024

The payment dates are the same as the dates of the OAS payments:

- January 29, 2024

- February 27, 2024

- March 26, 2024

- April 26, 2024

- May 29, 2024

- June 26, 2024

- July 29, 2024

- August 28, 2024

- September 25, 2024

- October 29, 2024

- November 27, 2024

- December 20, 2024

Canadian Pension Plan (CPP)

The CPP is a monthly, taxable benefit that serves as a replacement for a part of your income once you retire. If you are eligible for this benefit, you will receive it for the rest of your life.

Eligibility

- At least 60 years old

- Have contributed to the CPP at least once

How to Apply

You can apply online by logging in to your My Service Canada Account. You can also apply through a paper application. Download the CPP retirement pension application and mail the completed form to a Service Canada office.

Payment Amounts

| Type of pension or benefit | Average amount for new beneficiaries (January 2024) | Maximum payment amount (2024) |

| Retirement pension (at age 65) | $831.92 | $1,364.60 |

| Post-retirement benefit (at age 65) | $7.09 | $44.46 |

Payment Dates

- January 29, 2024

- February 27, 2024

- March 26, 2024

- April 26, 2024

- May 29, 2024

- June 26, 2024

- July 29, 2024

- August 28, 2024

- September 25, 2024

- October 29, 2024

- November 27, 2024

- December 20, 2024

Related: